Browsing Category

Trader Insights

118 posts

Curbing the Retail Forex Trader Paranoia

The paranoia of retail forex traders is legendary and justifiably so. To trade in such a volatile market loaded with “get rich quick” schemes would be naive. In fact, some of the more popular sites like forexpeacearmy.com focus heavily on the idea of a scam or someone trying to rip you off, and this idea…

The Ultimate Guide to Scalping

One of the top questions scalpers have is whether their broker allows scalping. There is constant anxiety among scalpers that if their profits swell to significant amounts, they will get blacklisted. But the real question is can you scalp trade without your broker noticing? Theoretically, yes, but it’s not quite that simple in practice. Lets…

Can Carry Trading Forex Double your Profit?

The forex carry trade is a strategy in which traders sell the currencies of countries with relatively low-interest rates and use the proceeds to buy currencies of countries that yield higher interest rates. Forex carry trading leverages the differences in interest rates between countries. For example, one country’s central bank may lower interest rates in…

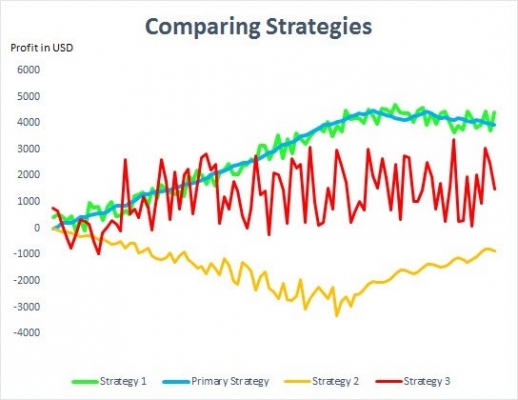

Combining Trading Strategies: A Help or a Hinderance?

If you’re not a new trader, you’ve probably had the urge to deploy several trading strategies simultaneously. That way, you can make money most of the time. Well, that’s the theory. The fact is that combining two different strategies often can do more harm than good. As a rule, I advise inexperienced traders to avoid…

Indicators: How to Find the Best Fit for You

A major concern for newer traders is finding which indicator works best for their trading style. A further consideration is whether their chosen indicator can be applied to beginner, intermediate and advanced trading categories as the trader gains experience. Personally, I don’t find it useful to think of indicators as being in categories, or this…

A Traders Secret Weapon: Making Trailing Stops Work for You

Trailing stops are a risk-conscious trader’s best friend. Trailing stops let forex traders lock-in profits and reduce the overall risks of trades as they advance. They protect profits by allowing a winning trade to remain open for as long as possible, closing it once the chart changes direction. This ensures you can stay in a…

Time Your Trades: Getting to Know MetaTrader’s Time Based Orders

Time-based orders allow you to request your order be filled at a specific time of day. These can be incredibly helpful when trading according to a high impact economic news event. However, there are restrictions on these depending on the specific exchange or market you are trading. Despite some technical limitations, these time-based orders are…

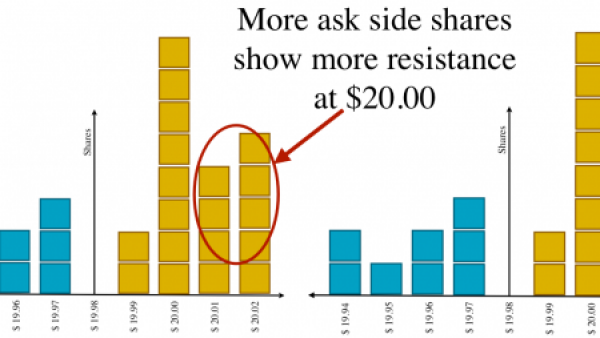

Finding a Match: Understanding Correlation in Forex

Correlation strategies appeal to forex traders because they remove the stress associated with picking market direction. For example, when two correlated pairs diverge, the idea is simply to buy one pair and sell the other. But are they really as reliable as they seem? What are Correlated Currency Pairs? Correlation offers a mathematical probability of…

Moving Average crossover using RSI

Simple systems stand the best chances of succeeding by not becoming overly curve-fit. However, adding a simple filter to a robust system can be a great way to improve its profitability, provided you also analyze how it may alter any risks or biases built into the system. The Moving Average Crossover System with RSI Filter…

Correlation in Forex

Correlation strategies appeal to forex traders because it removes the stress associated with picking market direction. When two correlated pairs diverge from one another, the idea is to simply buy one pair and sell the other. What are correlated currency pairs? Correlation offers a mathematical probability of two “time series” moving in the same direction.…