If you’re not a new trader, you’ve probably had the urge to deploy several trading strategies simultaneously. That way, you can make money most of the time. Well, that’s the theory.

The fact is that combining two different strategies often can do more harm than good. As a rule, I advise inexperienced traders to avoid combining strategies. Instead, they should give themselves time to hone their trading skills.

However, for more advanced traders familiar with the art of crafting a trading strategy, this can be an excellent way to boost your returns. But you need to proceed with caution. For this to work, your chosen strategies must fit perfectly together.

This article will help you decide how best to combine strategies to make them work for you. Hopefully, by the end of this, you will be able to do so in a way that enhances your performance rather than hurdle it.

Opposites Attract: Intervals

When incorporating two trading strategies, the first rule is that each has to make sense, money-wise. The thinking behind this follows the old saying, don’t put all your eggs in one basket. If one strategy underperforms, you have another running that could counter your losses.

For this to work, they have to work on different cycles. Ideally, one cycle should preferably be mid to long term and the other short term.

Let’s elaborate on that; suppose you’re a swing trader, and your primary strategy is to make a trade every few weeks. Then, your secondary strategy should be based on hours or one day, at the maximum. Why?

Because cycles in short term trades are, naturally, much shorter thus, there’s a greater likelihood that the trade won’t be correlated to the primary strategy and even it out.

Moreover, a short term strategy allows your available margin to work during a long term trade.

Trading Strategies and Correlation

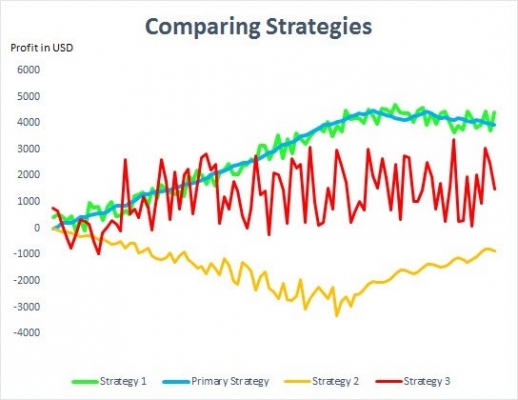

Below we can see returns of three different strategies that we can match to a long term primary trading strategy, shown in blue. The green, red, and yellow graphs represent the three possible short term strategies.

Assume the data in the chart is partial and that all strategies are profitable in the long term. But which is the most appropriate match?

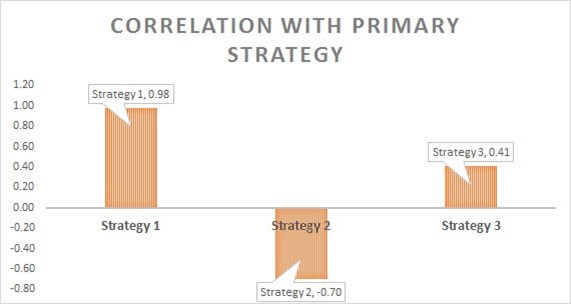

To answer this question, we must look at the second chart. Here, we measured the correlation of returns for each of the three short term trading strategies to our primary trading strategy. This is done via backtesting.

Let’s take a closer look at each trading strategy and its correlation with our primary strategy.

Strategy 1 has a correlation score of 0.98, meaning profits will largely move in tandem with our primary strategy. This immediately disqualifies strategy 1 as it means we will be losing money during the same period, amplifying the pain on the downside.

Strategy 2 is moving in the opposite direction with a -0.70 correlation score. You might think that a precisely reversed strategy is the one we need to match with our primary. Unfortunately, that’s a typical mistake.

If it goes exactly in reverse to your trading strategy, it will weigh on profits and vice versa. That is not a proper diversification; it simply reduces the volatility of your returns. If that is your goal, you can reduce your leverage; there’s no need for a secondary trading strategy.

That leaves us with one option, strategy 3.

With a low correlation of 0.41 to our primary, this choice allows for proper diversification of strategies. We know that a matching strategy is profitable. Thus, it’s best suited to enhance your primary strategy while it’s not doing well.

Conversely, a matching strategy won’t necessarily weigh when our primary trading strategy does do well. It moves at its own pace, detached from what’s happening in our primary strategy, making it a proper secondary trading strategy.

In summary, making a combined strategy profitable takes practice and careful consideration. However, using correlation and ensuring it makes sense money wise is a great place to start.