Correlation strategies appeal to forex traders because they remove the stress associated with picking market direction. For example, when two correlated pairs diverge, the idea is simply to buy one pair and sell the other. But are they really as reliable as they seem?

What are Correlated Currency Pairs?

Correlation offers a mathematical probability of two “time series” moving in the same direction. Applying the same idea to forex means that we need to pick two currency pairs, usually ones with the same currency in each pair or ones which include the same economies. EURUSD and USDCHF, which share USD, are two popular choices due to their extremely high correlation, so we’ll use those.

Now we ask the question: “If the EURUSD rises, what is the probability that the USDCHF will also rise”?

Our calculations will pump out a number between -1 and +1. +1 means that if Currency A rose in value, it is 100% certain that Currency B rose in value. -1 means that if Currency A increased in value, it is 100% certain that Currency B decreased in value. Finally, a value of 0 means that the movement of Currency A exercises no effect at all on Currency B.

Traders generally consider a correlation significant whenever the number is greater than 70%.

EURUSD and USDCHF are popular because they hold the strongest correlation among the major currency pairs. When market volatility is very low, correlation scores can be around -93%. However, their trading relationships have become far less stable thanks to European debt problems and the Swiss National Bank’s intervention.

Managing the Risk of a Correlating Strategy

Let’s move back into familiar territory with my favourite example, the moving average. You should know from experience that the average taken over the past 20 bars will differ when studying the 50 period versus the 200 period. Likewise, if you take the average on a 5-minute chart, the number will vary from that found on the hourly chart.

The take-away here is that the correlations work the same way.

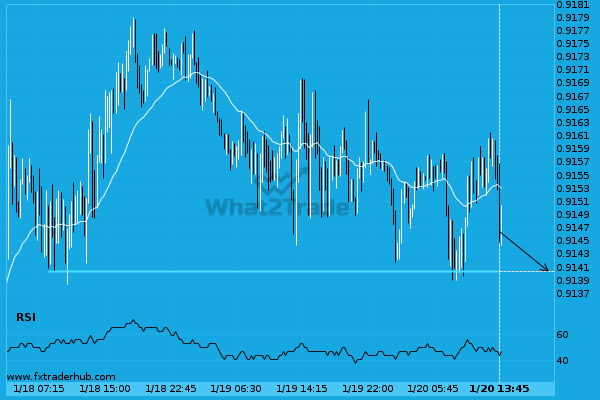

The correlation between EURUSD and USDCHF might even be positive if you look at a short enough time scale. As you back away in time, you will notice that the further out you go, the more steady the correlation numbers look. If the weekly correlation of the EURUSD and USDCHF is -80%, you would expect the numbers to get more wild and erratic as you scale all the way down to a tick chart.

The same problem also appears with the moving average. Studying the correlation over 50 periods provides a responsive number, but it is also far less consistent than the 200 period correlation. What a short period gains in responsiveness, it loses on stability.

Another aspect that you should also consider is whether the correlation that you’re studying makes fundamental sense. Just because the temperature change in Mongolia predicted the direction of USDJPY for the past week does not make it a reliable indicator for the future. The same goes with pair trading.

EURUSD and USDCHF should be highly correlated for two reasons:

- They both contain the same currency in the pair (USD), which half weights them with the same instrument.

- The EUR and CHF both have strong trading relationships with the US.

Therefore, you would expect both the Euro Zone and Switzerland to share a need for buying and selling US dollars. They need them for buying oil, importing and exporting to the US, etc.

As mentioned earlier, correlation traders typically settle on pairs that share a common currency. The EURUSD and USDCHF trade both share the US dollar. When you buy EURUSD and buy USDCHF, you are really:

Buying EUR and selling USD

Buying USD and selling CHF

Notice that the USD cancels itself out. What you are really doing is buying EUR and selling CHF. This is commonly known as the EURCHF pair. Assuming that the spread is not outrageous, it makes more sense to buy or sell EURCHF directly rather than going through the convoluted process of managing two open trades.

If you decide to pursue the two pair approach, you must consider the need to balance the trade sizes against each other.

Using standard lots as an example,

- 100,000 EUR is 137,500 USD.

- 100,000 USD is 90,900 CHF.

However, if you buy one standard lot of EURUSD, you buy $137,500. On the other hand, when you buy a standard lot of USDCHF, you only buy $100,000.

$137,500 obviously does not equal $100,000. So unless you intentionally decided to trade different sizes, you may want to consider equalizing them.

Here is how:

€100,000 / $137,500 = x * (₣90,900/$100,000)

x = €100,000 / ₣90,00 * $100,000 / $137,500 = 0.803

You would need your EURUSD trade to be 80% of the size of the USDCHF trade.

The Limitations of Correlation

Although helpful, correlation is limited. It only provides insight into the probability of direction but provides no insight into the strength of a particular move.

For example, a few months ago, the USDCHF climbed 1,000 points in value within a single day while the EURUSD only moved a few hundred pips. In this example, you can see the USDCHF moved dramatically further than the EURUSD in terms of pips and, more importantly, as a percentage of the price.

Consider then if you had gone short on EURUSD that day and short on USDCHF. In this case, you would have lost a ton of money. On the other hand, if you were long EURUSD and long USDCHF, you would have got lucky and earned the move.

Regardless of what happened, correlation told you nothing about the outcome when they move in the same direction. For that reason, I prefer looking at a less intuitive method called cointegration.

What is Cointegration?

Cointegration turns the correlation problem on its head.

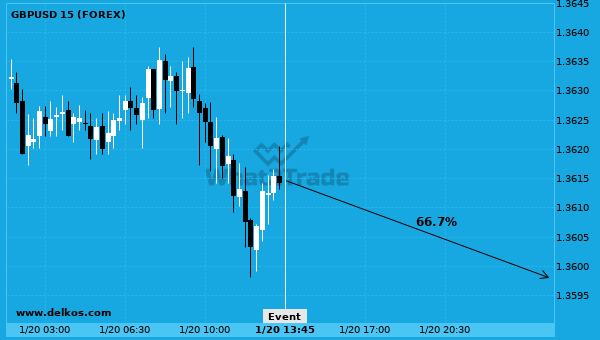

Rather than asking whether or not two pairs move in the same direction, it asks how likely they are to remain a certain distance apart.

Naturally, that distance tends to vary with time. Essentially, you want the cointegration formula to tell you how likely two pairs will come back to a standard distance. If you see two pairs spread unusually far apart, the numbers tell you that they usually come back together. At this point, it makes sense to consider a pair trade.

In the end, even with the most well thought out strategy, trading will always be heavily ladened with risk. While strategies such as correlation and cointegration can help inform your trading decisions, these choices will always be, at their core, an educated guess.