What can we say about trend lines? Is there any trader in the world that hasn’t used them? I seriously doubt it. We’ve been told time and again, “Trust the trend line. The trend line is our friend.” The visual appeal of a trend line is just irresistible. We all enjoy the confidence felt when the trend line is supporting our trade. It caps the market and “keeps it away” from our stop loss. Yet, that confidence could come at a dear price, especially when it comes to placing stop losses on the basis of a trend line.

What is a Trend Line?

Unfortunately, the answer is not as simple as a couple of dots with a line between them. But maybe that’s the wrong question. The question should be what makes the market move in a linear trend line, much like the nicely drawn one below? Trends come in all shapes and forms, but when the market moves linearly it creates a trend line.

But the question remains; what makes a market move in this way? When buyers/sellers emerge in cycles, and in a timely fashion, and buy or sell dependent upon the trend’s direction. In reality, banks, hedge funds, central banks and other market movers are the creators of that linear movement. That comes once they’ve collectively concluded the market’s direction. Then their periodic buying and selling create a linear movement in the pair and, hence, a trend line is born.

Beware of Trusting Trend Lines

First of all, let me be clear, I don’t believe “the trend is your friend.” Unless you have friends that regularly stab you in the back, then the trend is not your friend. While following a trend is very important, I always view it with suspicion. Maybe it’s about to surprise me or maybe there’s an indication that something is about to change.

The trend line is all about market movers buying and/or selling in a timely manner. And that means each subsequent time at a higher or lower price (depending on the trend). But here’s the thing; if you rely on the trend line for your stop loss you’re really counting on several different factors. For example, you’re counting on institutions to make timely trades, without abrupt selling or a sudden strategy change. And you’re counting on an absence of sudden volatility that could break the pattern.

Don’t get me wrong, as I’ve said, a trend line is important. But can you really count on the market to be that predictable? Of course, you can’t. While we like to think of trading as some combination of wit, intuition and logic, that’s not the case. In reality, trading without acknowledging the unpredictable is a one-way lane toward a losing street.

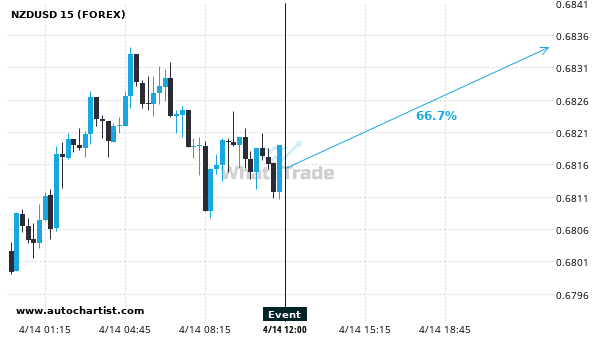

The sample below illustrates what too often happens; the trend line is abruptly broken. Those who placed their faith in the trend line and placed their stop loss under it were knocked out. Eventually, the bullish trend line continues but you’ve already missed the trend. It’s not just your stop-loss that you hit; it’s the loss of potential gain that really hurts. Think about a swing trader who rides trends over several weeks. Being knocked out of a trade could mean that their next opportunity might come only after several weeks or even several months.

There is a Solution

If placing your stop loss on the basis of a trend line was one of your methodologies, you may be discouraged. After all, what you’ve been relying on may eventually not work. But don’t despair because there is a solution and it’s easier than you think.

In conjunction with the trend line, you need to use indicators that consider volatility and the market’s standard deviation. For example, you could use Bollinger bands on top of a trend line and place your stop loss below it. Or, rather than relying solely on a trend line to determine whether a bullish (or bearish) trend is still intact, use exponential moving average crosses. Then, you’ll know, even if your trend line was broken, that the trend is still up.

There are a number of other tools that help make a good stop loss which take into account market volatility. But that’s a discussion for another day. What’s important to understand is that the trend line, alone, is unreliable for stop losses. Your take away from this article, then, is the realization that you can never trust a trend line by itself. You should always use indicators that capture market volatility and thus “complete” a trend line. While a trend line, in and of itself, is convenient, it simply does not have the ability to capture the changing pace of a trend in the long term.