In Forex, there’s a clear distinction between two groups of currencies—the majors and the exotics. The majors include the currencies that we all trade and which are relativity low in volatility, such as the US Dollar, the Japanese Yen and the Pound Sterling. Among the exotics, we can find riskier and more volatile currencies such as the Brazilian Real, the Russian Ruble and the Korean Won.

But most of us know, even if subconsciously, that within the exotics there are those which are somewhat “tradable,” such as the Chilean or Mexican Peso. And then, of course, there are those with more risk, for example the aforementioned Brazilian Real and Russian Ruble, as well as the Turkish Lira.

Those would be considered the “wild” currencies, usually eclipsed by some sort crisis which makes them highly unpredictable to the forex trader. Even if an opportunity emerges, if the currency is wild, most forex traders will move on to something safer. That’s a fair call. But there is a “third way;” I call it trading a proxy currency.

The logic is rather simple. Suppose you want to trade the Brazilian Real (or BRL), but you want to avoid the high level of volatility that comes along with trading it. You could either avoid the BRL altogether or you could trade a currency that has a correlation with the BRL but which is less volatile. However, correlation simply isn’t enough; the currencies must also be from the same family.

For example, in the case of the BRL, the Mexican Peso (or MXN) would be an excellent choice; both have correlation and both are commodity-related currencies in Latin America. Those are a perfect match because the MXN is less volatile yet clearly related. This is important because it means the correlation level is more stable and it means you could time your trades better.

The Two Layer Trigger

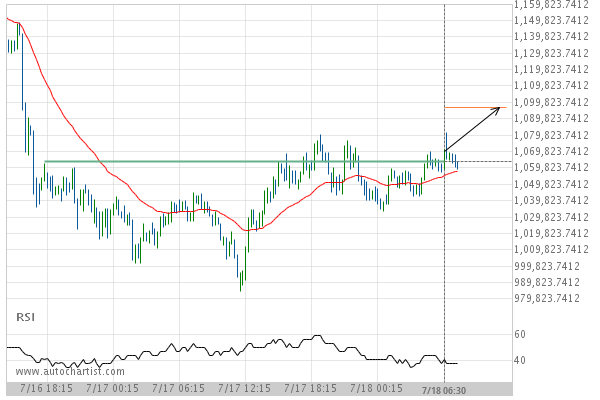

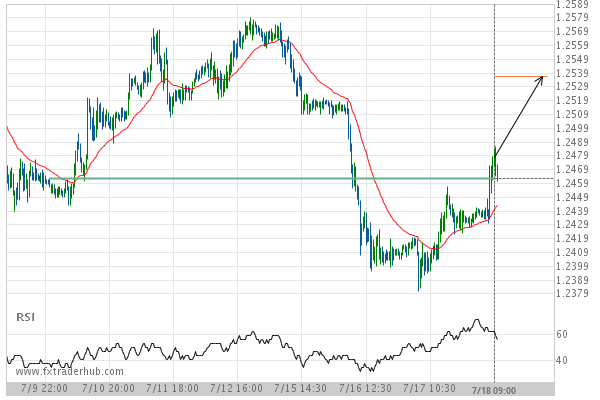

Continuing on with our BRL sample, once we found our proxy currency we next move on to practice. I like to call it the two-layer trigger. Let’s say we want to trade the USDBRL and use the proxy pair of USDMXN for the actual trade. Since we really want to trade only when the two are moving in tandem, we need two triggers to open one trade. We will want to get a buy/sell trigger in the USDBRL and then wait for another signal in the USDMXN to open our trade. If the two triggers are not activated then no trade is executed. As you can see in the sample below, at times the signal in the proxy pair appears in delay.

Why is the two-layer trigger important? Because, let’s face it, the reason to trade a wild currency in the first place is because something dramatic is happening and that means it can be quite lucrative. If the activity isn’t sufficient to move the currency and the currencies that move in tandem with it, then the activity is not dramatic enough. And if it’s not dramatic enough that means that the trend is weak and probably not worth the extra risk. In that case, you could just trade the USDMXN.

The Pros and Cons

So what is the benefit of actually trading a wild currency if a proxy currency is required? First of all, wild currencies tend to have dramatic movements that often don’t correlate with the major currencies. So the majors pairs are in a period of sideways trading, thus trading a wild currency through a proxy could generate profits when your other strategies are not. And it’s always a good idea to have strategies for different types of markets.

The downside is that, despite using a proxy, it is still more risky than trading majors, and it is even more complex if you’re not trading with an algo.

So worth it or not depends on your appetite for risk and complexity. But surely, under the right circumstances, trading a wild currency with a proxy could be rather rewarding.