Browsing Category

Trader Insights

118 messages

How to use Fibonacci Expansion to Set a Limit

You’re about to ride a bullish trend; you plan your stop loss and gauge how much you can risk. You also know the rule of thumb—that is that your profit should be at least twice the amount you are willing to risk. But how can you know if the trade you’re considering really has potential…

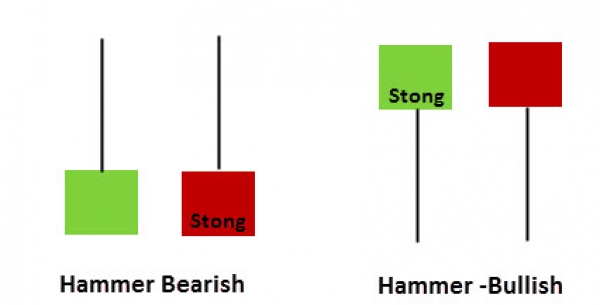

3 Candlesticks Every Trader Should Know

Understanding the various types of candlesticks is one of the first things every novice trader should learn. But the experienced trader should also never forget the candlesticks’ significance. Because sometimes, when you have to figure out what’s about to happen with a certain pair and all other indicators fail, it’s the basics of reading candlesticks…

Trading with the Alligator Indicator

The Alligator Index, as its name suggests, is highly effective at biting down on trading opportunities, or more appropriately, momentum opportunities. The Alligator Indicator is comprised of three SMMAs, or three Simple Moving Averages, that run on averages. The three SMMAs are aptly named the Jaw, the Teeth and the Lips. The Jaw, the slowest…

Use a Gann Fan with Oscillators

Buying into a bullish trend on the dips is a popular long term strategy. You focus on the USD/JPY or any other pair that is on a long term bullish trend, wait for it to dip and jump in. You buy when the pair is low and just wait for the trend to continue. Yet…

Why is it worth watching the Gold Silver ratio?

There are many ratios in the trading world that are worth watching. But when it comes to trading precious metals there is one key ratio that everyone must know and should watch. That, of course, is the Gold Silver ratio which is essentially the price of Gold divided by the price of silver. You might…

Parabolic SAR vs MACD

Parabolic SAR and MACD are both very effective in spotting pivots and yet there is a difference. In some cases, you will find the Parabolic SAR is more effective while in others you might find the MACD more useful. That is why, in order to make the best of both, you must know the advantages…

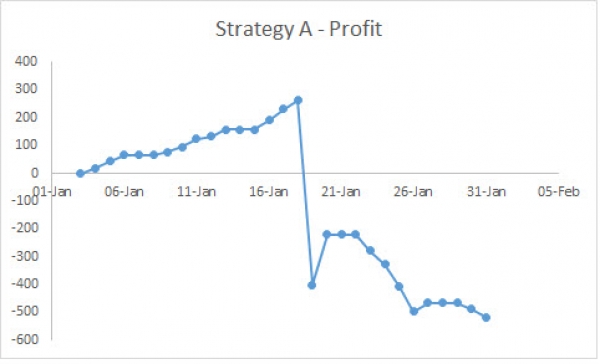

Analyzing Trading Algos with 3D Charts

These days, any mention of the term 3D is associated with entertainment. But in fact, when it comes to charting, and more specifically to charting your trading algo, 3D charting is not only insightful but provides important practical advantages. The most common chart to measure a trading algo is profit over time. That lets you…

Optimize your Algo

You have created a trading algo. The Algo is profitable in the backtester. Before unleashing it with real money, you’ve got to first tighten the screws. That is, ensure your algo is fine-tuned so it can deliver optimal returns. There’s one major challenge ahead of you. Firstly, your strategy is rather simple. You may go…

Oscillators that you need to use

Oscillators, one of the most interesting groupings of technical indicators, are designed to signal overbought and oversold levels. Oscillators are a family of indices that go beyond the mathematics. They focus on one important thing and that is momentum, or more specifically changing momentum. Before we delve into which Oscillators are best to use and…

Learn how to trade a wild currency

In Forex, there’s a clear distinction between two groups of currencies—the majors and the exotics. The majors include the currencies that we all trade and which are relativity low in volatility, such as the US Dollar, the Japanese Yen and the Pound Sterling. Among the exotics, we can find riskier and more volatile currencies such…