Nikkei 225 is trapped in a Channel Up formation, implying that a breakout is Imminent. This is a great trade-setup for both trend and swing traders. It is now approaching a support line that has been tested in the past. Divergence opportunists may be very optimistic about a possible breakout and this may be the start of a new trend. It may also be that this convergence factor may result in the ideal setup for swing traders that are on the lookout for a possible bounce-back. Whatever happens, an initial move towards 47146.5625 is expected in the short term.

ARTÍCULOS RELACIONADOS

FTSE 100 heading towards a price it has tested 4 times in the recent past.

The movement of FTSE 100 towards 9254.6602 price line is yet another test of the line it reached…

CAC 40 is signaling a possible trend reversal on the intraday charts with price not breaching support.

Emerging Ascending Triangle pattern in its final wave was identified on the CAC 40 30 Minutes chart. After…

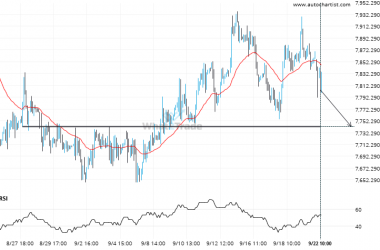

If you’re long CAC 40 you should be aware of the rapidly approaching level of 7742.7002

A strong support level has been identified at 7742.7002 on the 1 hour CAC 40 chart. CAC 40…