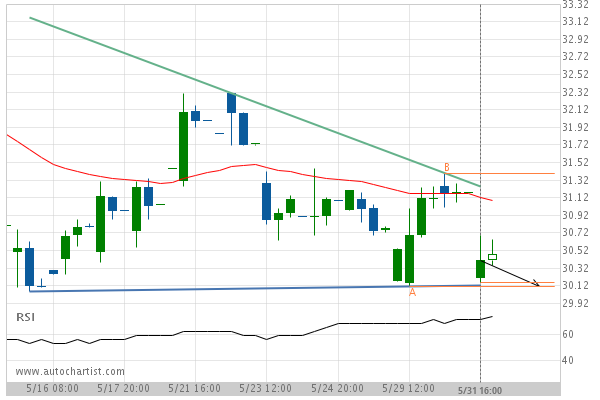

DowDuPont is heading towards the support line of a Descending Triangle and could reach this point within the next 2 days. It has tested this line numerous times in the past, and this time could be no different from the past, ending in a rebound instead of a breakout. If the breakout doesn’t happen, we could see a retracement back down to current levels.

ARTÍCULOS RELACIONADOS

NKE – approaching a support line that has been previously tested at least twice in the past

Emerging Falling Wedge detected on NKE – the pattern is an emerging one and has not yet broken…

An unexpected large move occurred on GOOGL Daily chart. The shift stands out in recent activity.

GOOGL just posted a 26.23% move over the past 28 days – a move that won’t go unnoticed…

If you’re short V you should be aware of the rapidly approaching level of 344.1500

V is heading towards a line of 344.1500. If this movement continues, the price of V could test…