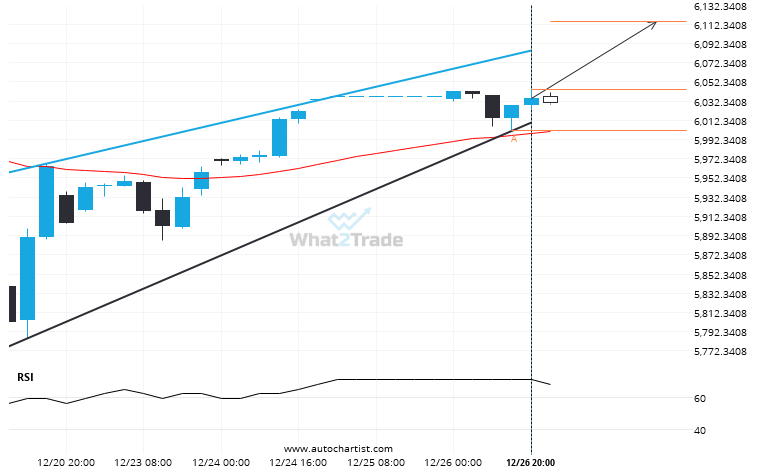

US 500 is trapped in a Pennant formation, implying that a breakout is Imminent. This is a great trade-setup for both trend and swing traders. It is now approaching a support line that has been tested in the past. Divergence opportunists may be very optimistic about a possible breakout and this may be the start of a new trend. It may also be that this convergence factor may result in the ideal setup for swing traders that are on the lookout for a possible bounce-back. Whatever happens, an initial move towards 6115.4050 is expected in the short term.

Related Posts

US 500 formed a Channel Up on the 1 hour chart. Retest of support in sight.

US 500 is trapped in a Channel Up formation, implying that a breakout is Imminent. This is a…

Because NAS 100 formed a Channel Up pattern, we expect it to touch the resistance line. If it breaks through resistance it may move much higher

NAS 100 is approaching the resistance line of a Channel Up. It has touched this line numerous times…

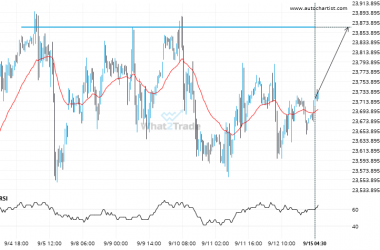

DAX 40 keeps moving closer towards 23863.9004. Will it finally breach this level?

DAX 40 is about to retest a key horizontal resistance level near 23863.9004. It has tested this level…