Browsing Category

Trader Insights

118 messages

The Ultimate Signal for Range Bound Trading

The single most evident quality of range bound is, quite simply, falling volatility or Standard Deviation. As Standard Deviation falls, the pair has smaller fluctuations and therefore is “bound” within a range. Likewise, when Standard Deviation is low we are stuck in a range. If we can time Standard Deviation (and we can), we can…

4 Easy Trading Tricks to Earn More Pips Per Trade

If you are creating a trading system to trade manually or have programmed into an expert advisor, the first thing you need to do is create a solid trading strategy. The logic behind your strategy needs to take into account changing markets, use proper money management and look to gain long term, consistent gains. In…

What is the yardstick for successful trading?

Regardless of whether you are trading Forex, stocks, gold or beans, everyone who considers themselves a “trader” wants to be successful. For many, this means fulfilling the goal of replacing their current income with gains made from trading. For others, it might mean reaching levels of wealth and security impossible to reach with their “day…

Trailing Stop Systems: Bullish Bearish Bar and Round Numbers

Using a trailing stop allows you to let price action dictate when to get out of the trade. In non trending markets, using a trailing stop can reduce your risk or get you out of the trade with a small gain. In trending markets, the trailing stop can safely keep you in the trade longer…

When Your Trading Strategy Stops Working

You had a great strategy, it was working well and it was making you money. The problem? Suddenly, market conditions have changed and your strategy no longer works. Markets are too volatile, too choppy. It’s as though the only thing your strategy can produce is a screen full of red. It seems like your strategy…

Using the Accumulation/Distribution Indicator

A double bottom that fails to hold, resistance that gets sliced in a heartbeat or just a trend that surprisingly breaks. Those are just a few of the”nasty” pitfalls that nearly every trader regularly encounters. Those pitfalls are seemingly out of the blue but are, in fact, just a result of another dimension acting in…

What makes a successful trader?

The percentage of successful forex traders is relatively small, yet they share certain similarities: A well-built trading system, plus the right combination of personality traits and learned behaviors. Of course, the tools are important – Regardless of a trader’s personal characteristics, a successful trader always builds, uses or finds a good Expert Advisor (EA). Most people…

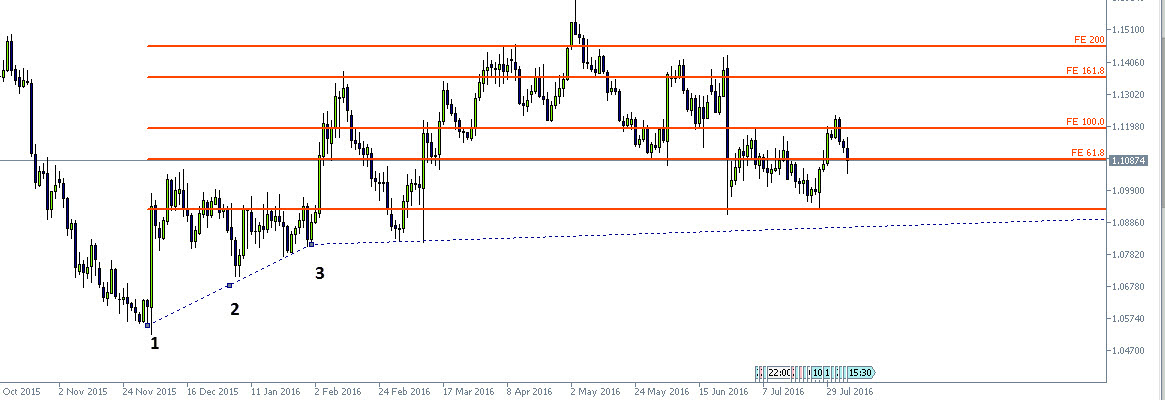

Use Fibonacci Expansions

You’re about to ride a bullish trend; you plan your stop loss and gauge how much you can risk. You also know the rule of thumb—that is that your profit should be at least twice the amount you are willing to risk. But how can you know if the trade you’re considering really has potential…