Browsing Category

Trader Insights

118 messages

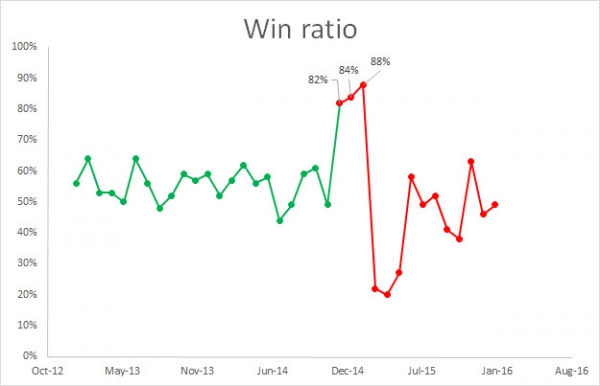

Beware of a Trading Strategy That Does Too Well

Can a trading strategy be doing too well? That sounds counter-intuitive, certainly. Like suggesting that someone can be too rich or too successful. You might be thinking there’s no such thing. But when it comes to managing your trading strategy, one that is performing too well is a warning sign. That’s because, quite often, an…

Correction vs Change in the Trend

How many times you have seen an FX pair, or any other instrument for that matter, start moving opposite to the trend? Did you wonder was it a mere correction or were you perhaps witnessing a change in trend? Your conclusion will have an acute impact on how you choose your next trade and thus…

Trading Successfully When You’re Nervous

Trading textbooks are filled with methods and techniques to reduce the tension you feel when trading. Suggestions range from the most common, i.e. starting with small amounts and low leverage to instilling a disciplined strategy. If you’ve just started your trading adventure then this is exactly what you need. But perhaps you’ve got a different…

Strategy for the Novice Trader

Lately, I’ve been asked fairly often why I don’t write more for the novice trader. Well, good news! If you are, indeed, a novice trader then this trading strategy is right up your alley. But even if you’re not a newbie, you might still find this tip useful. This rather simple and straightforward strategy doesn’t…

“It depends how thick your crayon is!” Full commodity market analysis

The great trade execution debate. Trade execution models and the terms STP, ECN, DMA, B-book / A-book, MM are widely discussed and often casually thrown about in conversations between traders and brokers. However, it goes so much deeper than this and getting an in depth understanding of an ideal execution model, its setup and what…

Backtesting for efficiency

Your forex backtests are absolutely worthless if you do not test the statistical entry efficiency and exit efficiency of the strategy. Everyone that runs a backtest inevitably reports the dollars earned as the outcome. Other factors exist like the average win to loss, the profit factor and the Sharpe ratio, but they do not tell…

Effective Trendline Navigation

As with virtually any trading scenario, we must first determine the direction that we need to trade the pair for the greatest likelihood of success. By looking at the historical 4 hour chart of the GBPUSD below, there are several reasons we know that we want to go long (buy) the pair. Price action is…

As with virtually any trading scenario, we must first determine the direction that we need to trade the pair for the greatest likelihood of success. By looking at the historical 4 hour chart of the GBPUSD below, there are several reasons we know that we want to go long (buy) the pair. Price action is…

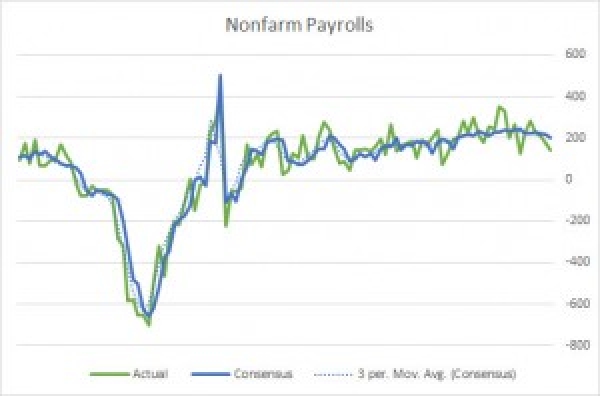

Tips for Trading Nonfarm Payrolls

On the first Friday of each month the US Labor Department issues its Nonfarm Payrolls report. Among other labor-related data, that report provides the numbers of new US-based private sector jobs. The NFP, as it’s also sometimes called, is one of the few economic indicators that day traders and investors keenly watch. Usually, when the…

Trailing Stop Techniques: Candle High Candle Low And Average True Range

Trailing stops use price action to determine when to exit the market. The purpose of moving the stop is to reduce risk, eliminate risk and lock in profits. Let’s go over the specific techniques. X Candle High / X Candle Low Trailing Stop Technique This technique uses a set amount of closed candles in the…