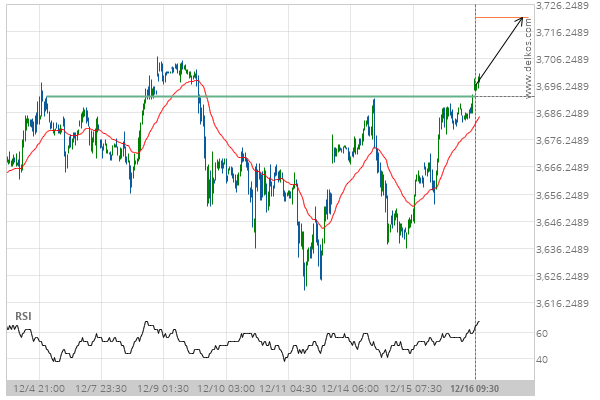

E-mini S&P 500 MARCH 2021 has broken through a line of 3692.0000 and suggests a possible movement to 3721.2251 within the next 2 days. It has tested this line numerous times in the past, so one should probably wait for a confirmation of this breakout before placing a trade. If the breakout doesn’t confirm, we could see a retracement back to lines seen in the last 10 days.

Related Posts

Breach of support could mean a start of a bearish trend on Silver Spot

This trade setup on Silver Spot is formed by a period of consolidation; a period in which the…

Gold Spot seems to be on its way to resistance – a possible opportunity?

Gold Spot is approaching a resistance line at 3871.7600. If it hits the resistance line, it may break…

Important support line being approached by US Oil. This price has been tested numerous time in the last 8 days

An emerging Falling Wedge has been detected on US Oil on the 30 Minutes chart. There is a…