Browsing Category

Trader Insights

118 posts

The Alligator Indicator

The Alligator Index, as its name suggests, is highly effective at biting down on trading opportunities, or more appropriately, momentum opportunities. The Alligator Indicator is comprised of three SMMAs, or three Simple Moving Averages, that run on averages. The three SMMAs are aptly named the Jaw, the Teeth and the Lips. The Jaw, the slowest…

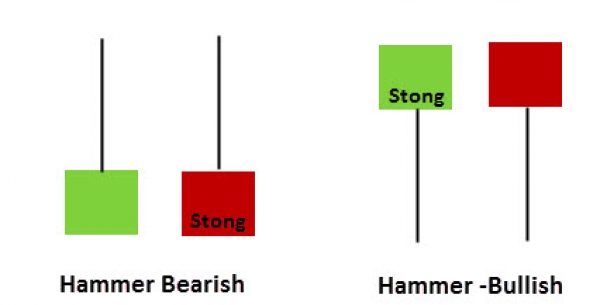

3 Candlesticks that Every Trader Should Know

Understanding the various types of candlesticks is one of the first things every novice trader should learn. But the experienced trader should also never forget the candlesticks’ significance. Because sometimes, when you have to figure out what’s about to happen with a certain pair and all other indicators fail, it’s the basics of reading candlesticks…

Using Gann Fan with Oscillators

Buying into a bullish trend on the dips is a popular long term strategy. You focus on the USD/JPY or any other pair that is on a long term bullish trend, wait for it to dip and jump in. You buy when the pair is low and just wait for the trend to continue. Yet…

Oscillators that you will need

Oscillators, one of the most interesting groupings of technical indicators, are designed to signal overbought and oversold levels. Oscillators are a family of indices that go beyond the mathematics. They focus on one important thing and that is momentum, or more specifically changing momentum. Before we delve into which Oscillators are best to use and…

Successful trading when nervous

Trading textbooks are filled with methods and techniques to reduce the tension you feel when trading. Suggestions range from the most common, i.e. starting with small amounts and low leverage to instilling a disciplined strategy. If you’ve just started your trading adventure then this is exactly what you need. But perhaps you’ve got a different…

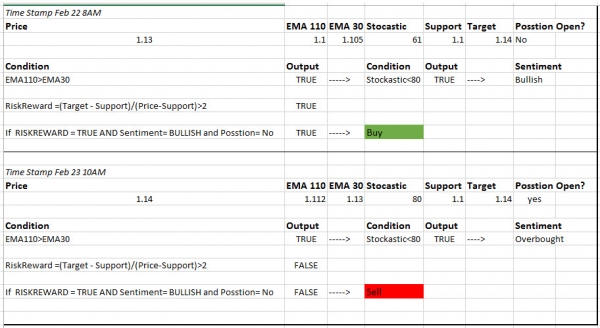

Strategy for a novice trader

Lately, I’ve been asked fairly often why I don’t write more for the novice trader. Well, good news! If you are, indeed, a novice trader then this trading strategy is right up your alley. But even if you’re not a newbie, you might still find this tip useful. This rather simple and straightforward strategy doesn’t…

A correction vs change in trend

How many times you have seen an FX pair, or any other instrument for that matter, start moving opposite to the trend? Did you wonder was it a mere correction or were you perhaps witnessing a change in trend? Your conclusion will have an acute impact on how you choose your next trade and thus…

Trading Wild Currency

In forex, there’s a clear distinction between two groups of currencies—the majors and the exotics. The majors include the currencies that we all trade and which are relativity low in volatility, such as the US Dollar, the Japanese Yen and the Pound Sterling. Among the exotics, we can find riskier and more volatile currencies such…

Be careful of a Trading Strategy That Does Too Well

Can a trading strategy be doing too well? That sounds counter-intuitive, certainly. Like suggesting that someone can be too rich or too successful. You might be thinking there’s no such thing. But when it comes to managing your trading strategy, one that is performing too well is a warning sign. That’s because, quite often, an…

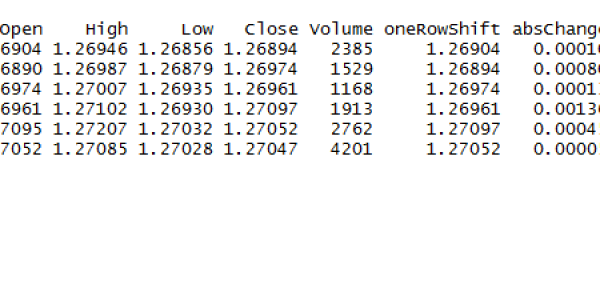

Time based orders in MT4

The short summary is that time based orders in MT4 are possible. You just need to keep in mind some of the technical limitations. MetaTrader 4 EAs work based off of incoming ticks. Whenever the bid/ask changes by a micro pip or more, that event triggers the EA to do something. When the markets hum…