Browsing Category

Trader Insights

118 posts

Dual Stochastic Forex Strategy for better results

Stochastic oscillators can be a valuable tool for mechanical forex traders. Yet, traders often use stochastics together with numerous unrelated indicators, and the results are generally ho-hum. Like some other traders, I’ve found that using a single stochastic oscillator usually doesn’t produce consistent winners. One stochastic by itself doesn’t seem to yield eye-popping gains. The…

Mechanical Trading Systems

Much ink has been devoted to pinpointing the causes of mechanical trading systems failures, especially after the fact. Although it may seem oxymoronic (or, to some traders, simply moronic), the main reason why these trading systems fail is because they rely too much on the hands-free, fire-and-forget nature of mechanical trading. Algorithms themselves lack the…

The Martingale Strategy

A Martingale forex strategy offers a risky way for traders to bet that that long-term statistics will revert to their means. Forex traders use Martingale cost-averaging strategies to average-down in losing trades. These strategies are risky and long-run benefits are non-existant. Here’s why Martingale strategies are attractive to forex traders: First, under ideal conditions and…

Do not trust the Trend Line

What can we say about trend line? Is there any trader in the world that hasn’t used them? I seriously doubt it. We’ve been told time and again, “Trust the trend line. The trend line is our friend.” The visual appeal of a trend line is just irresistible… trimming the trend and showing you the…

The Ground rules of day trading

Day trading is challenging. Don’t let anyone tell you otherwise. The odds are stacked against you and the risks of loss seemingly lurks at every turn. That’s why it’s important to understand some ground rules about day trading. The rules are there so that you can safely swim with the sharks. Range is Key for…

Repaint Indicators in MetaTrader

Repainting indicators are one of the most common problems facing would-be EA designers. Sometimes it seems like an indicator really has its thumb on the market. It perfectly predicts when the market will go up or down. Making an EA run off of the indicator is a no-brainer. If this sounds familiar, then you need…

Guppy Multiple Moving Average (GMMA)

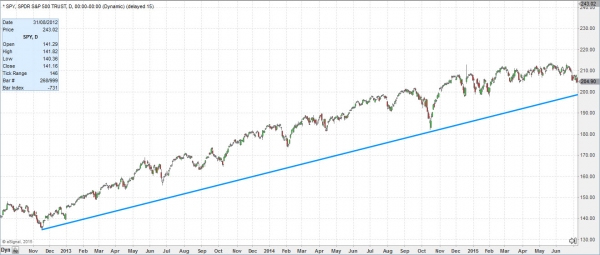

One of the most frustrating things about constructing a trading system can be the absolute freedom to use whatever indicators and values you like. While this can initially sound positive, the virtually limitless combinations of variables can become quite overwhelming. For example, if you like the concept of the SPY 10/100 SMA Long Only System…

Formulas for Common Money Management

All of the EAs that we program generally use one of three types of money management. I don’t really like that term, though. I believe that position sizing formula is generally more accurate. The options are: Fixed Lot Size Use a percentage of available margin Lose a certain percentage of the account balance whenever the…

The Multiple Day Mean Reversion System

The Multiple Day Mean Reversion System is designed to pick up quick profits from ETFs that wander a little too far from their current trend. It is based on the mean reversion assumption that all markets will eventually revert back to their average price. Similar to the 3 Day High/Low Mean Reversion System, this one…

Double Tops Trading Secrets

The double top pattern is no doubt among the simplest and most familiar price patterns in technical analysis. Typically, a double top pattern is followed by a sell off. In theory, this rather simple pattern should be easy for traders to pounce on and yet, too often, it’s a cause for frustration. That’s because the…