There are many ratios in the trading world that are worth watching. But when it comes to trading precious metals there is one key ratio that everyone must know and should watch. That, of course, is the Gold Silver ratio which is essentially the price of Gold divided by the price of silver. You might be asking yourself what insights one could possible glean with such a ratio? The answer is potentially very valuable insights.

What the Gold Silver Ratio Means

On the surface, Gold and Silver should be identical, from a fundamental standpoint. They are both precious metals which investors buy as a hedge against fear. But, of course, that explanation just barely scratches the surface. When we dive a bit deeper into the fundamental nature of Gold demand vs Silver the difference becomes much more apparent.

Gold, as its reputation suggests, is a safe haven tool primarily driven by investments. Investments in Gold are often driven by fear and risk aversion (which are two sides the same coin). Thus, we can attribute most of Gold’s price fluctuations to those sentiments.

Silver demand, on the other hand, is only partially driven by investments. Industrial usage accounts for the lion’s share of Silver’s demand.

That difference creates a very interesting dynamic. When investors’ fears mount, demand for Gold tends to be stronger and the ratio tends to rise. When the scenario brightens then investors believe industrial output will rise. That, of course, tends to benefit Silver and thus the ratio falls.

The Gold Silver Ratio as an Indicator

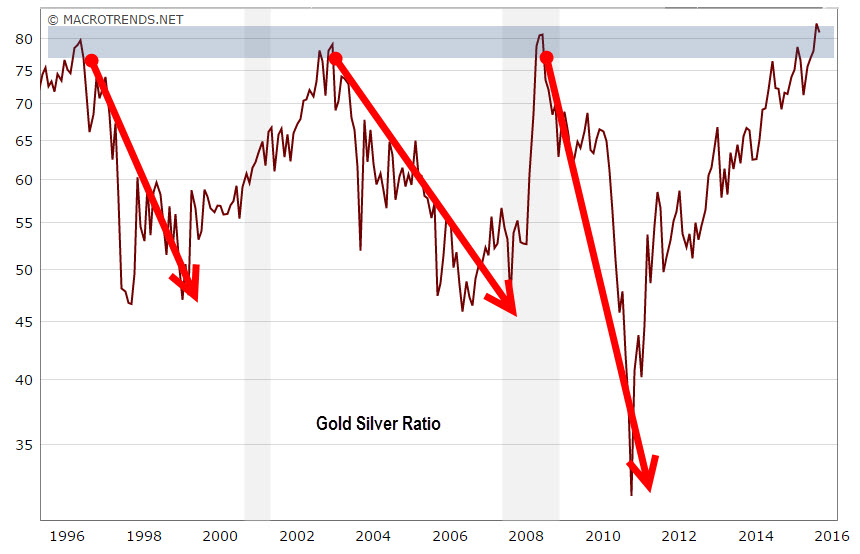

Examining the Gold Silver ratio chart below, a trader is able to take the pulse of fear levels. If the ratio is rising it may signal an escalation in investors’ fears. Consequently, that could signal that Gold demand is turning stronger. If the ratio is falling, fear is dissipating and Gold is turning weaker.

How is this useful in practice?

If you’re holding a long Gold position and the ratio is falling, you’re essentially riding a dying horse. The trend could flip and Silver would be the better place to be. On the other hand, if the ratio is on the rise and you’re buying Gold, that’s positive reassurance.

Of course, for Silver, the effects of the ratio would be the exact opposite. A rising ratio is an indication of weaker Silver demand.

It Gets Complicated

But besides gauging which precious metal is strengthening at the expense of the other, there’s one other dimension. Once again, the Gold Silver ratio chart sheds some light on this useful ratio.

The Gold Silver ratio has cycles. It has historical highs, where it tends to top out and fall, and it has historical lows. If the ratio is near its highs, then it might be a good idea to move into trading Silver. If the ratio is near its historical lows, it might be time to switch from trading Silver to trading Gold.

Trading the Gold Silver Ratio

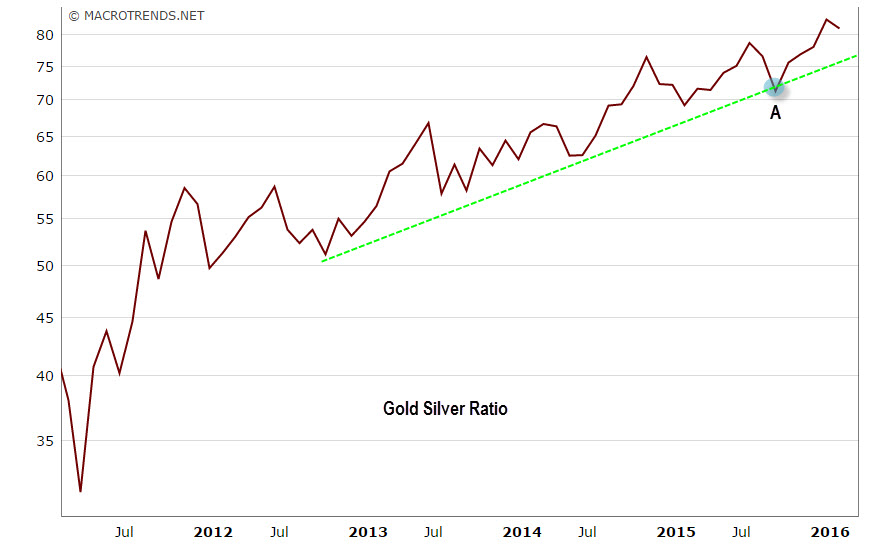

This might come as a surprise but the Gold Silver ratio is not just an indicator it’s also tradable. Even better, it’s actually rather easy to trade. Often, the ratio has simple and very distinct patterns that can follow a simple trend line. If you believe the ratio will trend higher, then you can buy Gold and short Silver with identical lot sizes. That way you will gain as the ratio rises.

For shorting the index one should do the opposite; short Gold and buy Silver with the same lot sizes.

For example, take a look at Point A from October of 2015. The ratio gained more than 10%, rising from 71, to where the trend line is above 80; that’s more than a 10% gain. Compare that to trading the EUR/USD; a 10% gain in the pair would roughly equal 1,000 pips.

Naturally, this simplicity doesn’t come cheap. First, you have to rely primarily on trend lines for short to mid-term trends (and you know what I think about relying too heavily on trend lines). Of course, you can use the historical lows and highs to figure out what’s coming next but that means opportunities might be fewer. Second, this is margin heavy, since you essentially need to hold twice the margin, aka two positions in opposite directions.

Put another way, trading the Gold Silver ratio can be simple when it’s going right, but consider this could easily go wrong.

In Conclusion

If you plan to actually trade the Gold Silver ratio, first get used to using it as an indicator. Then, once you have a better sense of the way it behaves, you can use your own discretion as to whether or not it’s worth trading. If you’re thinking about using the ratio solely as an indicator, let me throw this out there: Don’t entirely rule out trading it. Occasionally, when the ratio is at a multi-year low or high, there can be a very nice opportunity arising that you might not want to miss. But the fact is, either way, as an indicator or as a tradable asset, the Gold Silver ratio is always worth watching