The paranoia of retail forex traders is legendary. Some of the more popular sites like forexpeacearmy.com focus heavily on the idea of a scam or someone trying to rip you off. The idea extends to the brokers as well. Traders frequently blame their losses on broker manipulation or games.

This undoubtedly happens. I worked as a broker, so I definitely am aware of the most common techniques to manipulate accounts. If you feel like a broker targeted you individually, then you should ask, “Am I worth targeting?”

If your account balance is under $50,000, I assure you that the answer is a definitive no. Think about the costs involved paying a dealer to sit around and pick on trader Johnny. Does it make sense to pay a dealer to steal $20 from Johnny’s $2,000 mini account whenever the market gets near his stop loss? The broker has bigger fish to fry. He doesn’t know or care that Johnny has an open trade.

Market manipulators look at the entire order book or at the whales. If you’re floating a fat, juicy loss of $50,000 and you’re dumb enough to tell the dealer that your pain threshold is 1.3850 (the stop is the public pain threshold), then he will do everything in his power to goose the market to 1.3850. He knows you’ll exit and lock in the loss. Your pain is his gain. That is when stop hunting pays.

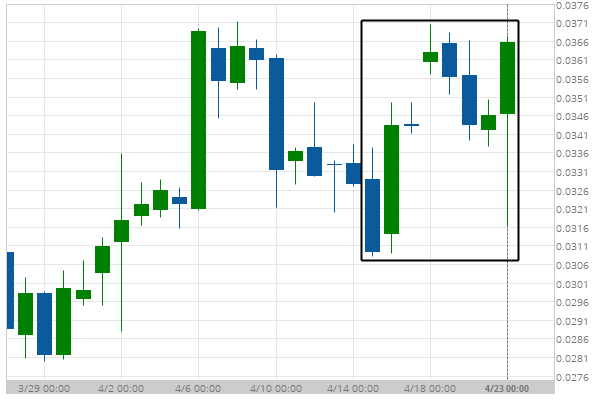

Alternatively, and this is where most retail traders feel victimized, is that 300 different clients all put stop orders within 5 pips of each other. These order clusters happen very frequently, especially near round numbers like 0 and 50. The market appears to magically dip into the cluster, set off all the orders and then return to where it was 10 minutes later.

It’s not an accident and it’s not magic. If you knew that you could force 300 traders to eat their losses and you would make a pile of money doing it… the decision makes itself. You either push the market into the cluster or you shouldn’t be trading.

Traders that feel targeted turn to EAs with so-called stealth stops and take profits. It’s a common programming request that we receive for making custom EAs. Instead of sending the stop loss and take profit to the broker, an Expert Advisor remembers what their values are. Whenever the market hits your exit criteria, the EA sends a request to exit at the market price. The perceived advantage is that nobody knows, including the broker, the price at which you desire to exit.

The major disadvantage to this technique is that you subject your orders to extra lag time between the exit signal and the time when the exit occurs. My personal experience is that stealth execution nearly always results in poorer execution. The price received is usually worse than would have happened by placing the order with the broker and eliminating the lag time.

The only plausible reason for using stealth stops is if your trade size puts you in the “juicy” category from the dealer’s perspective. If you are a fat target, then you should consider placing your account at a larger brokerage where you don’t stand out as much. You also should consider reducing the position size – large losses frequently result from overleveraging a trade.