Parabolic SAR and MACD are both very effective in spotting pivots and yet there is a difference. In some cases, you will find the Parabolic SAR is more effective while in others you might find the MACD more useful. That is why, in order to make the best of both, you must know the advantages and weaknesses of each.

Parabolic SAR has Higher Sensitivity

The first thing you will notice when comparing a Parabolic SAR to an MACD indicator is that the Parabolic SAR signals many more pivots. That is because the Parabolic SAR has, by default, more sensitivity to minor changes. Of course, you can reduce the level of sensitivity, but even so, it delivers more signals than the MACD.

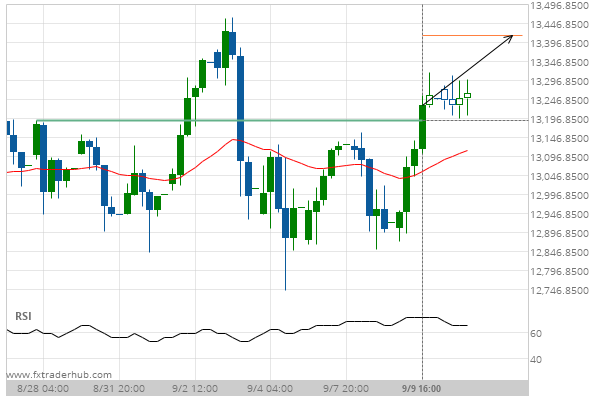

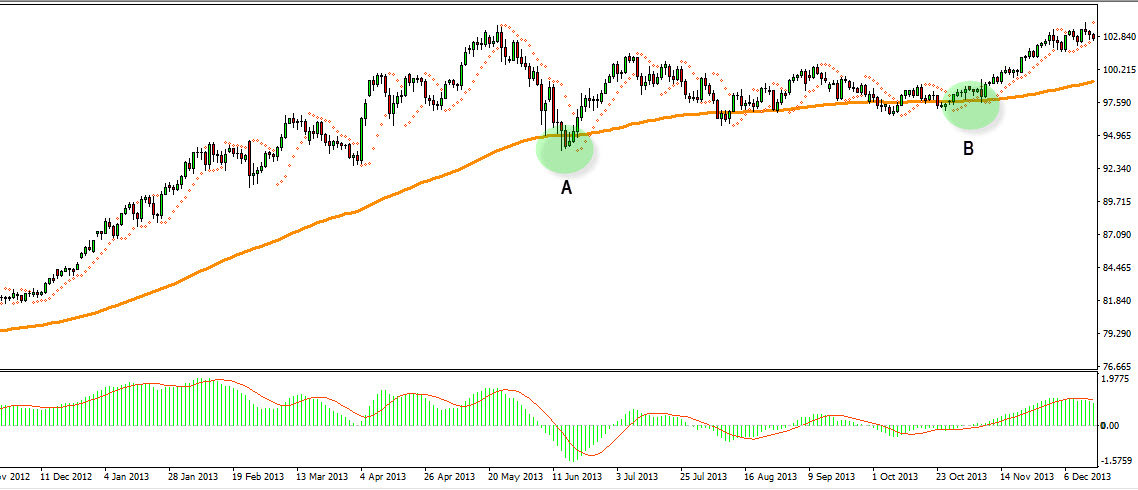

The benefit of such sensitivity is that, at times, the Parabolic SAR predicts a pivot before the MACD. But that sensitivity has a downside. In small fluctuations the Parabolic SAR can occasionally produce fake pivots. As you can see from point A to point B, the pair has been trending sideways and still the Parabolic SAR delivered plenty of signals, most are falls. However, the MACD during the same time frame was much more effective.

MACD is better at Momentum

One advantage the MACD has over Parabolic SAR is the measurement of momentum. As can be seen in the chart above, the MACD indicator, through the lows and the highs of its histogram, illustrates how strong the momentum is to either direction. If the histogram falls sharply lower, the momentum is strongly bearish, if it rises sharply higher, the momentum is highly bullish, if the histogram is fluctuating close to 0, the momentum is weak.

While the Parabolic SAR does a good job in identifying the direction of momentum quicker, it is much less effective in identifying the strength of a pair’s momentum. And that is why, when it comes to momentum, MACD is more effective than Parabolic SAR.

Limit/Stop Loss

Another way in which MACD and Parabolic SAR differentiate is in the way they influence stop loss and limit strategy.

Parabolic SAR, being an upper indicator, is overlaid on the price rather than being presented below. The dots of the Parabolic SAR are natural stop loss and limit levels for the short term. Moreover, when used in conjunction with Fibonacci levels, can also be effective in placing long term stop loss and limit orders.

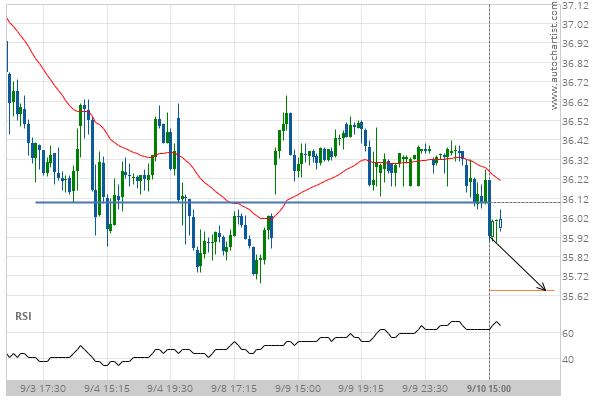

MACD, however, being a lower indicator, i.e. presented below the chart rather than overlaid, has a more complex relationship with stop loss and limits. The MACD can be effective as an indicator for a stop loss when momentum shifts to the other direction, thus pointing to a pivot. But for the MACD to be effective as a stop loss indicator it needs a Gann Fan or an area where the MACD momentum converged more than once, indicating a strong support, or resistance if the trend is bearish.

In Conclusion

Both the Parabolic SAR and the MACD are strong tools for working with pivots, but are different in their effectiveness. One is better in identifying pivots quickly and in placing limits and stop loss, the other is better at analyzing momentum strength and timing entry. Knowing the advantages of each can allow you to optimize the use of both and, more importantly, optimize your performance.