Browsing Category

Trader Insights

118 posts

The Aroon Indicator

Through this column we have covered many oscillators which are generally very effective in analyzing momentum; they include the Average True Range, MACD and the VIDYA. Some oscillators are better at predicting short term momentum, while some are lagging indicators and tend to shine brighter when it comes to long term momentum. Yet, in this…

The Accumulation/Distribution Indicator

A double bottom that fails to hold, resistance that gets sliced in a heartbeat or just a trend that surprisingly breaks. Those are just a few of the“nasty“ pitfalls that nearly every trader regularly encounters. Those pitfalls are seemingly out of the blue but are, in fact, just a result of another dimension acting in…

Optimized RSI

The 2-period Relative Strength Index (RSI) can work as a short-term trade entry signal. After providing plenty of supporting evidence in their book, Short Term Trading Strategies That Work, Larry Connors and Cesar Alvarez went on to discuss a system that would make use of this powerful entry signal. About The System The Cumulative RSI…

Mathematical Expectation in Your Trading

Some forex traders use the same trading strategy for all currencies, while others use entirely different strategies depending on the currency pairs being traded. Or, traders may use multiple strategies with multiple forex pairs, in order to perhaps increase profits while reducing the risk of drawdown resulting from over-concentration on a single strategy. Expert advisors…

MACD Histogram Bars – A Fast Entry Signal

Traders who use the MACD indicator often are critical of the fact that it will signal an entry after the initial move has begun and, therefore, pips are left on the table. As such, many traders wanting to enter a trade sooner dismiss it as a “lagging” indicator. In the case of the MACD indicator,…

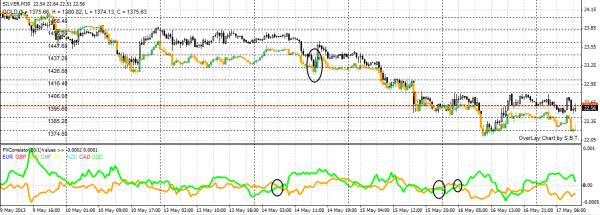

Trading Pairs Gold and Silver

Finding a pair of currencies or commodities that can stand up to the cointegration test on both a short term and long term basis can be quite difficult. It is common for pairings to have some degree of distance or long term deviation away from the linear regression and this can greatly affect performance. Several…

Forex Dow Theory Concepts

There’s hardly a trader, whether short term or long term, who doesn’t rely, in some form or another, on technical analysis. Yet many don’t know that the backstory behind what we today refer to as technical analysis is actually a collection of ideas on trading stocks. Some of those ideas are, in fact, more than…

Trading Symmetrical Triangles

I always like to say, that in any trading strategy, you should only be exposed to the market when absolutely necessary. That is, whether it’s a strategy running on daily intervals or on monthly intervals, a trader should not stay in the market longer than needed because it leaves room for the unexpected. This is…

Trading Spirals of Contraction and Expansion

I offer every novice trader I meet one invaluable piece of advice and that is that markets have a pulse. When you trade, whether it’s the EURUSD pair or Gold or any other asset, there is a certain spiral-like cycle, with constant contraction and expansion. Identifying the waves of contraction and expansion is a powerful…

Trading with the Commodity Channel Index

When trading, one of the most important pieces of information to have is the ability to identify momentum—when it begins and when it ends. It can help you plan your next trade and to ensure that that trade is successful. It is in the process of charting momentum that the Commodity Channel Index is especially…