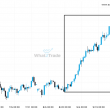

NAS100 has broken through the resistance line of a Pennant technical chart pattern. Because we have seen it retrace from this position in the past, one should wait for confirmation of the breakout before trading. It has touched this line twice in the last 7 days and suggests a target line to be around 10867.4700 within the next 2 days.

Related Posts

After testing 24489.3008 numerous times, DAX 40 is once again approaching this price point. Can we expect a bullish trend to follow?

The movement of DAX 40 towards 24489.3008 price line is yet another test of the line it reached…

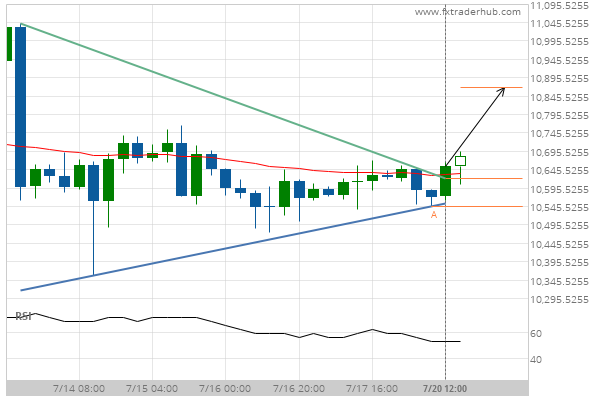

NAS 100 – approaching a resistance line that has been previously tested at least twice in the past

The movement of NAS 100 towards the resistance line of a Rising Wedge is yet another test of…

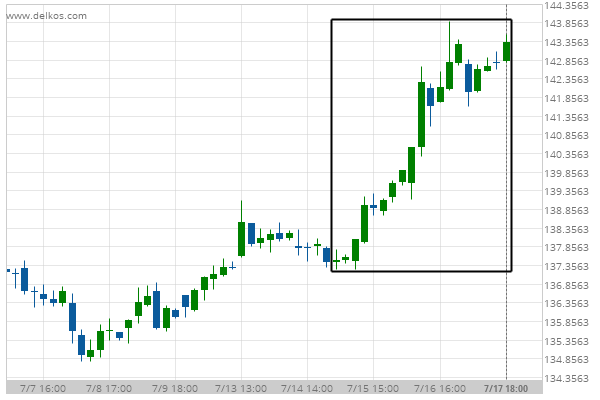

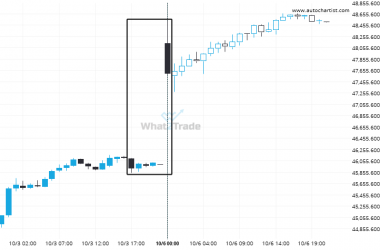

Nikkei 225 reached 47590.0 after a 3.64% move spanning 3 days.

Nikkei 225 reached 47590.0 after a 3.64% move spanning 3 days.