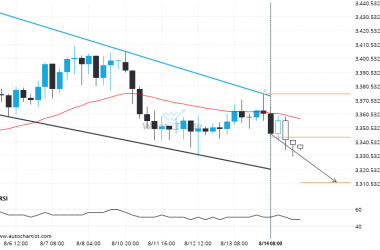

Natural Gas is trapped in a Falling Wedge formation, implying that a breakout is Imminent. This is a great trade-setup for both trend and swing traders. It is now approaching a resistance line that has been tested in the past. Divergence opportunists may be very optimistic about a possible breakout and this may be the start of a new trend. It may also be that this convergence factor may result in the ideal setup for swing traders that are on the lookout for a possible bounce-back. Whatever happens, an initial move towards 3.4108 is expected in the short term.

Related Posts

Natural Gas – approaching a support line that has been previously tested at least twice in the past

The movement of Natural Gas towards the support line of a Channel Up is yet another test of…

Gold Spot is quickly approaching a very important level it has previously tested numerous times in the past

Gold Spot is moving towards a key resistance level at 3359.3501. Gold Spot has previously tested this level…

Because Gold Spot formed a Falling Wedge pattern, we expect it to touch the support line. If it breaks through support it may move much lower

An emerging Falling Wedge has been detected on Gold Spot on the 4 hour chart. There is a…