Day: August 6, 2020

26 posts

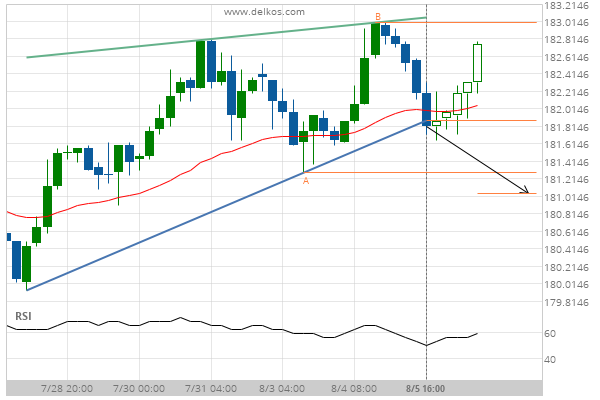

After testing support twice in the past, US Treasury Bond SEPTEMBER 2020 has finally broken through. Can we expect a bearish trend to follow?

The breakout of US Treasury Bond SEPTEMBER 2020 through the support line of a Rising Wedge could be…

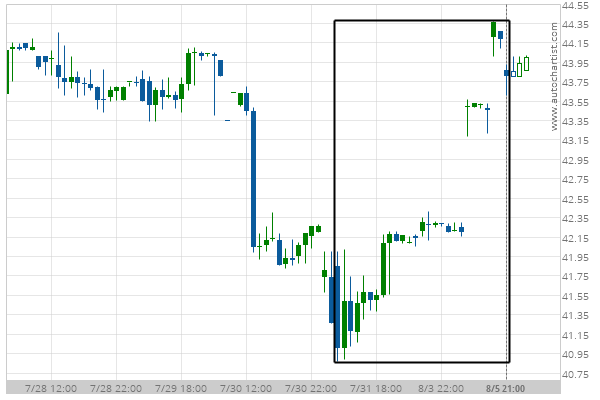

After experiencing a 6.83% bullish move in the space of 6 days, nobody knows where Exxon Mobil Corp. is headed.

Those of you that are trend followers are probably eagerly watching Exxon Mobil Corp. to see if its…

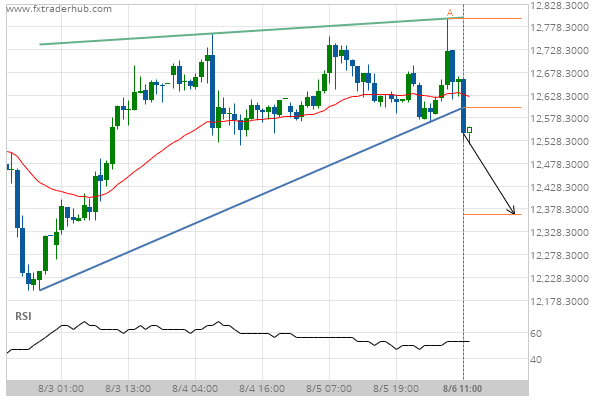

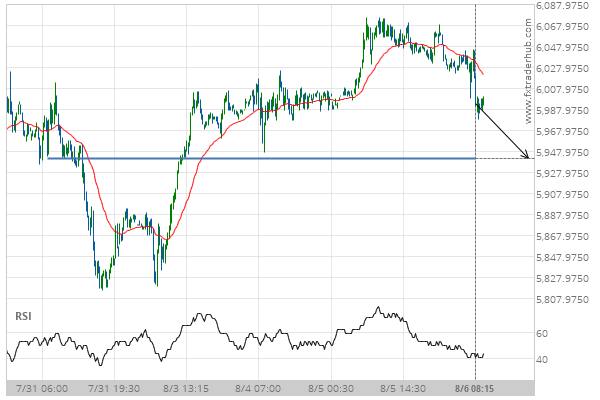

Big movement expected on GER30 after a breach of the support

GER30 has broken through a support line of a Rising Wedge and suggests a possible movement to 12365.5901…

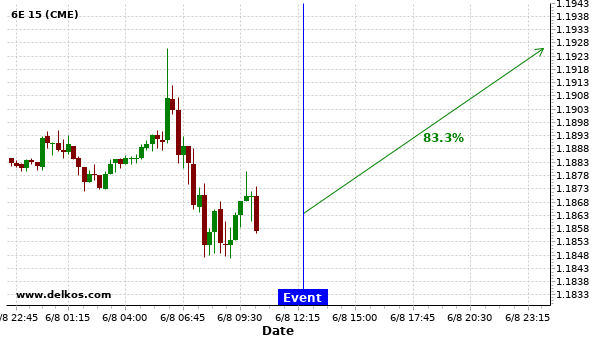

We expect 6E to trend upwards today.

Based on the last 12 Continuing Jobless Claims events in United States, we expect 6E to trend upwards…

Important price line being approached by UK100. This price has been tested numerous times before.

UK100 is moving towards a line of 5941.0000 which it has tested numerous times in the past. We…

Oscillators that you will need

Oscillators, one of the most interesting groupings of technical indicators, are designed to signal overbought and oversold levels. Oscillators are a family of indices that go beyond the mathematics. They focus on one important thing and that is momentum, or more specifically changing momentum. Before we delve into which Oscillators are best to use and…

Successful trading when nervous

Trading textbooks are filled with methods and techniques to reduce the tension you feel when trading. Suggestions range from the most common, i.e. starting with small amounts and low leverage to instilling a disciplined strategy. If you’ve just started your trading adventure then this is exactly what you need. But perhaps you’ve got a different…

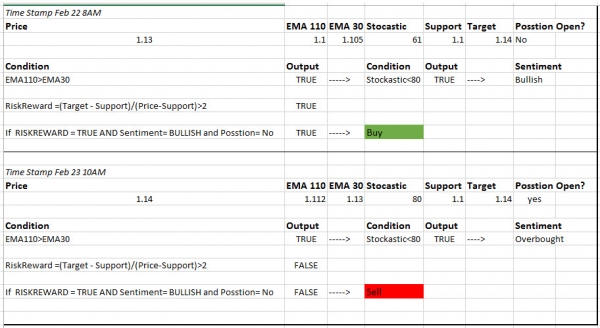

Strategy for a novice trader

Lately, I’ve been asked fairly often why I don’t write more for the novice trader. Well, good news! If you are, indeed, a novice trader then this trading strategy is right up your alley. But even if you’re not a newbie, you might still find this tip useful. This rather simple and straightforward strategy doesn’t…

A correction vs change in trend

How many times you have seen an FX pair, or any other instrument for that matter, start moving opposite to the trend? Did you wonder was it a mere correction or were you perhaps witnessing a change in trend? Your conclusion will have an acute impact on how you choose your next trade and thus…

Be careful of a Trading Strategy That Does Too Well

Can a trading strategy be doing too well? That sounds counter-intuitive, certainly. Like suggesting that someone can be too rich or too successful. You might be thinking there’s no such thing. But when it comes to managing your trading strategy, one that is performing too well is a warning sign. That’s because, quite often, an…